Gen Zs are increasingly concerned about their gut health because it has manifested as part of the generation’s obsession with “self-transformation”.

According to a senior lecturer at City, University of London¹ , this generation may be more sensitive to mentions of dieting or weight loss, so framing gut concerns under gut health on different media channels can help Gen Zs approach this topic better.

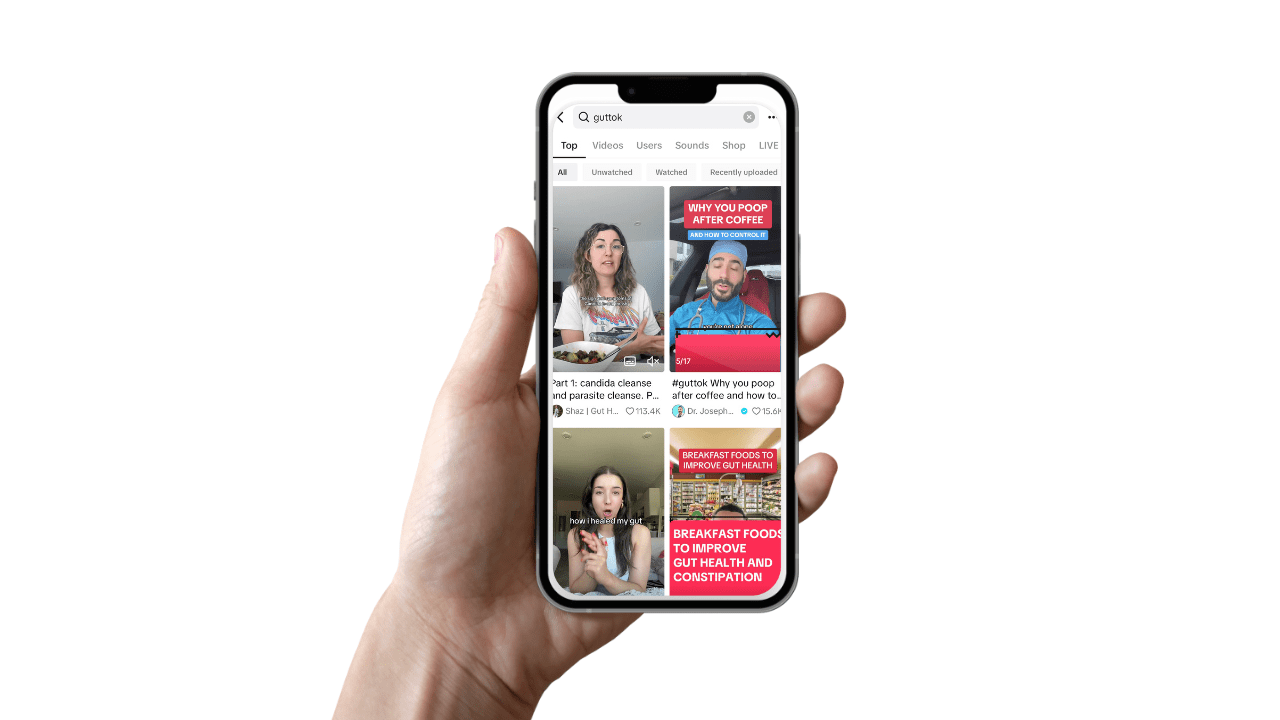

The increased palatability also brings more attention to the topic of gut health. For more open-minded Gen Zs, this overarching gut health conversation also taps into bowel discomforts and indigestion issues – which are more explicit, taboo topics that previous generations of consumers shied away from in public discourse.

As a generation, Gen Zs are also more aware of different aspects of health and wellbeing such as mental health.

And with the rise in studies that explain the close interconnections of the gut-brain axis and the impact that gut health and mental health has on each other, Gen Zs may be more inclined to pay attention to gut health as a result.