SUGGESTED SEARCHES

Consumer Deep Dive Series: The Activity Seekers

Consumer Deep Dive Series: The Activity Seekers

The Global State of Health & Wellbeing – Volume 2

This is Part 3 of 5 of our Consumer Deep Dive Series, an article series on the consumer segments identified in The Global State of Health & Wellbeing Report - Volume 2. Read Part 1 and Part 2.

There is no one-size-fits-all approach to nutrition, so it is crucial for brands to tap into the nuanced needs and habits of consumer types to best engage with them. In the third article in our Consumer Deep Dive series, we explore Activity Seekers – who make up 14% of global health-conscious consumers identified in our Consumer Segmentation Report.

Activity Seekers are mostly young adult males aged 44 and below, living and working in cities, who are concerned about their physical and mental health, and highly involved in managing their health & wellbeing. However, they prioritise exercise to manage their health instead of restricting what they eat and drink, as they perceive nutrition only as a mean to fuel their sports performance. Nutrition is less of a focus for this consumer segment, and they don’t feel guilty when they do eat unhealthily, because they think they will compensate for it through exercise.

Of Activity Seekers prefer to manage their health through physical activity instead of restricting what they eat/drink. |

Of Activity Seekers say they don’t really think about what they eat.

Of Activity Seekers believe they don’t need to make changes to their diet as it is already healthy enough.

Activity Seekers might be one of the hardest health-conscious consumer segments for brands to reach as they prefer managing their health through physical activity, don’t prioritise nutrition and, as many are at the start of their careers, have lower purchasing power. So why does it make sense for brands to try to reach them, and how should they do it?

A fresh take or something new

Even though Activity Seekers say they don’t prioritise their nutrition intake, they belong to an adventurous demographic that likes to trailblaze when it comes to trying new nutrition products and brands. Nearly half say they are usually the first to try new health foods with a significant 14% saying they do so to impress others.

They are drawn to new flavours of brands they are familiar with, with 26% saying it is a reason for them to try a new product. Adding novelty to familiar products in the form of additional ingredients may also be a way to entice Activity Seekers to try something new.

For example, phospholipids are known for their proven mental health benefits, and we know that 76% of Activity Seekers are concerned about their mental health. Meanwhile, protein powder is well-known to promote muscle growth, so a value-adding protein powder, like Nutiani’s Brain and Body Powder, that supports stress management and promotes optimal performance could be a great way of capturing this market.

Unlike more conservative segments such as Practical Worriers, Activity Seekers are drawn to innovative product formats, especially drinks and powders, as well as baked goods, like cookies, that have been fortified with proteins.

Another way brands can promote novelty to Activity Seekers is through partnerships with sports brands and athletes who they already have strong interest in and loyalty to.

These innovations and partnerships will require upfront investment, but it’s wise for brands to build loyalty with this young and burgeoning market. While they are in the earlier part of their careers and generally have a lower disposable income than other segments now, this will change in the coming years, and we know that the older-skewing demographics favour brands they know and trust.

Building their understanding of holistic health

Even though Activity Seekers are very involved in managing their health and wellbeing, only half are satisfied with their overall condition. And yet of all the consumer segments, Activity Seekers score the lowest in terms of believing it is important to prioritise all aspects of health and wellbeing (including physical, mental, and inner health).

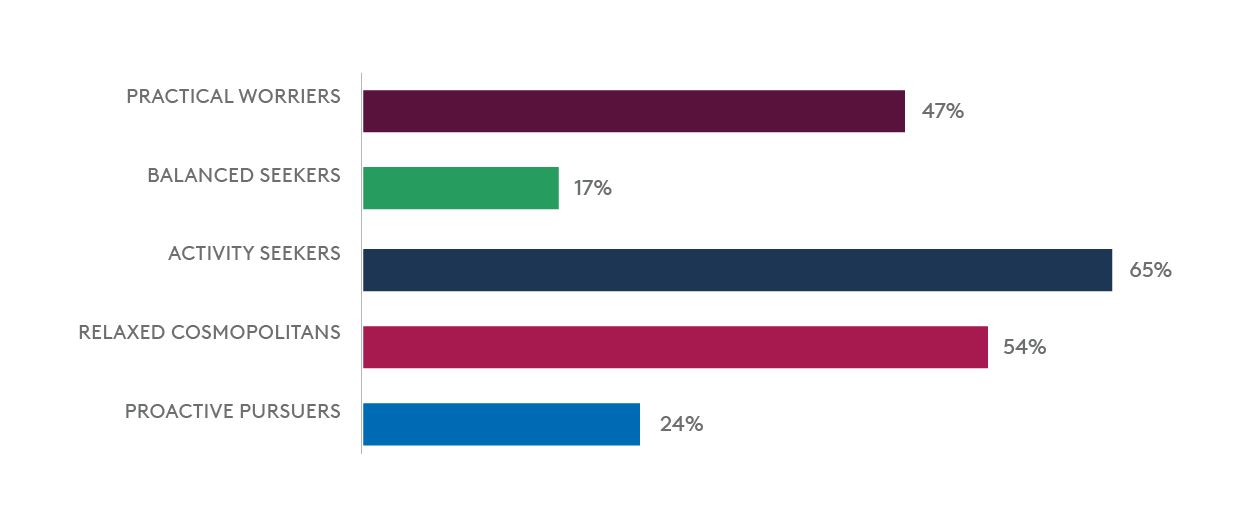

Despite their belief that their diets are healthy enough and they don’t need to make any changes in their nutrition habits, 65% aspire to an overall healthier lifestyle, but don’t know how to start.

Figure 1: Overall agreement with ‘I want to live a healthy lifestyle, but I don’t know how’.

What this means is there’s a strong desire among Activity Seekers to improve their wellbeing, but as they only prioritise physical activities to manage their health, there is an opportunity to expand their understanding of holistic health, and nutrition’s crucial role as an enabler of good health.

Did You Know?

Only 34% of Activity Seekers are satisfied with their knowledge of nutrition. This presents an opportunity for brands to educate the segment on the connection between nutrition and physical performance.

Volume One of our Global State of Health & Wellbeing report revealed 88% consumers understand the importance of nutrition to overall health and wellbeing, and our Third Volume delved into rising consumer understanding of the interconnectedness of mental, inner and physical health. There is an opportunity for brands to help Activity Seekers expand their understanding of the importance of nutrition in improving sports performance, as well as the interconnectedness of mental and physical health.

Unsurprisingly, given their younger skew, the group prefers bite-sized media formats, with Instagram and Youtube rating highly, followed by TV. Dynamic, clever videos that demonstrate how inner and mental wellbeing impact physical health and performance, and nutrition as a cornerstone of health, would resonate well with this segment.

Affordability is attractive

Cost matters to Activity Seekers, who cite price as the main barrier to improving their nutrition. That said, cost is also a motivator to trying new products that are cheaper than other existing products on the market.

Multifunctionality boosts a product’s value-for-money, especially when consumers can clearly understand how a single product can help them to improve one or more areas of health all at once.

The challenge is to prove, via education, marketing, and clear labelling, that a new product with additional multifunctional ingredients, such as phospholipids, probiotics or lactoferrin, will provide better value for money than other products on the market.

The bottom line for appealing to Proactive Pursuers

In conclusion, Activity Seekers can appear as one of the most difficult health-conscious consumer segments to reach and grow as they prefer managing their health through physical activity, don’t prioritise nutrition and have lower purchasing power. However, because they are highly involved in managing their health and wellbeing, this young and dynamic consumer group presents a multitude of opportunities for brands.

Unlike more conservative segments like Practical Worriers, they are open to experimentation and novelty products. Through education, marketing and well-priced, multifunctional products, there is an opportunity for brands to invest in building long-term loyalty as Activity Seekers increase their purchasing power, as well as their understanding of the interconnectedness of wellbeing.

As a wellbeing nutrition brand, we help customers navigate the diverse needs of their consumers and work closely with them to tailor solutions that resonate with all groups. If you’re interested in launching a new nutrition product, please reach out to us to learn more about how we can help.

STAY AHEAD