To help me meet my nutritional needs

SUGGESTED SEARCHES

This is part 2 of 3 of our special deep dive article series into China’s Health and Nutrition Consumption Trends and Opportunities in 2024. Subscribe to Nutiani’s monthly newsletter to be notified when the next part is released.

Through our proprietary consumer research conducted in partnership with Ipsos, we found that: safety, confusion and taste are the three important obstacles. If healthy nutrition brands can break through these three barriers, they will win more opportunities in the market.

In recent years, Chinese consumers' awareness of food safety has been increasing. This heightened concern is rooted in historical food safety scandals that have plagued China, such as the 2008 melamine milk scandal, which severely undermined consumer trust in domestic food products. As a result, the safety of nutraceuticals is one of the main barriers preventing consumers from purchasing these products.

are concerned about food safety and quality

When asked about the challenges they face when consuming nutritional products, or what prevents them from purchasing these products, two primary concerns emerged:

say the long-term effects of consuming these products are unclear

are concerned about adverse side effects

This shows that about one-third of consumers are worried about the safety of nutritional products, regardless of whether they currently purchase them.

Market Opportunities

When asked about the top three attributes they consider when purchasing a nutritional product, 16% of consumers cited sustainable products and product origin as important. This underscores the importance of transparency and ethical sourcing in building consumer trust. Chinese consumers' strong concern about food safety and quality offers a significant opportunity for brands that can provide pollution-free and safe food raw materials, such as grass-fed dairy:

Our New Zealand Grass-Fed Difference

New Zealand is one of the few places in the world where cows can graze on fresh pasture all year round. At Fonterra, we adhere to natural grazing methods and high standards of "real grass feed." This commitment allows us to provide Chinese consumers with pure, nutritious, safe, and reliable dairy products.

No Growth Hormone

The New Zealand government bans the use of animal growth hormones in dairy farming. Our dairy farmers never use growth hormone (rBST) to increase milk production.

Grass-Fed Grazing

Our cows roam freely in the paddocks. On average, our New Zealand cows get 96% of their food from pasture and spend 97% of their time grazing outdoors.

Certification and Audit

Our Evernatural grass-fed grazing standards are certified and audited annually by an independent body, AsureQuality. They conduct yearly management system and data compliance audits to ensure the integrity of our grass-fed grazing claims.

Animal Welfare

New Zealand's high animal welfare standards are internationally recognized. Our cows graze for more than 350 days a year.

Consumers today are bombarded with a plethora of nutritional information. The conflicting advice makes it challenging for them to manage their health through diet, leading to confusion about which products are right for them.

say "I'm not sure which product is right for me."

Market Opportunities

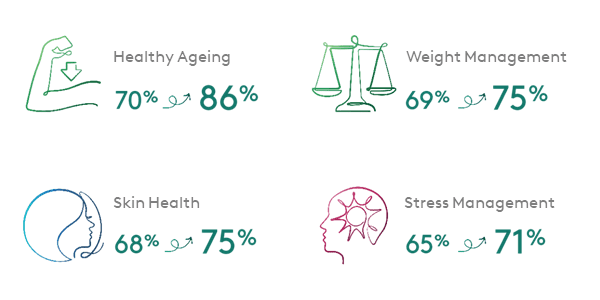

Brands have the opportunity to bridge this "perception gap" by prioritizing evidence-based knowledge to guide consumers' purchasing decisions and enhance consumer confidence. Health concerns such as immunity, sleep quality, and digestive/intestinal health remain top priorities for Chinese consumers. There has also been a growing emphasis on weight, stress, aging, and skin health since 2021.

Focusing on these areas can drive significant market growth. For instance, addressing immune health, sleep quality, and digestive health can attract a broad consumer base, while specialized markets such as weight management, stress levels, and skin health present rapid growth opportunities.

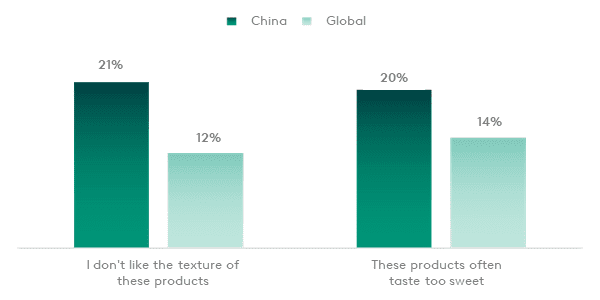

While Chinese consumers are keen to use nutrition to promote health, the taste of nutritional products remains a significant barrier. Many consumers find that nutritional products do not taste good, which is a considerable deterrent.

Challenges faced when consuming nutritional products

This issue is not only confined to nutritional supplements but extends to the broader category of healthy, balanced diets. In our survey, 39% of respondents indicated that a "healthy and balanced diet is not palatable," making it the second most cited challenge.

Market opportunities

Snacks are increasingly viewed as an opportunity to supplement nutrition in China. For many consumers, snacks provide a convenient way to add extra nutrients to their diet.

Top 5 reasons for consuming snack products (food or beverages)

To help me meet my nutritional needs

Provides me with extra nutrients not found in my regular diet

To boost my mood

To help maintain adequate nutrition

To improve my overall health

Most preferred delivery formats globally by health concerns

The demand for portable and convenient nutritional solutions is growing. Ready-to-drink beverages, such as nutritional drinks and yogurt drinks, are particularly popular. Between October 2022 and September 2023, 24.2% of new energy drinks launched in China catered to this trend.

As more consumers seek nutritional solutions without compromising on taste and texture, there is a substantial opportunity to increase engagement by enhancing the nutritional profile of everyday foods, including treats. Brands must innovate to ensure that products are not only nutritious but also enjoyable to consume.

With more consumers interested in nutritional solutions but less willing to compromise on taste and textures, there is a huge opportunity to increase engagement by enhancing the nutritional profile, and hence healthfulness, of everyday foods, including treats. As brands innovate, they must remember: If the product does not taste good, customers will not repeat their purchase.

Stay ahead in the evolving health and nutrition sector with valuable data and strategies listed in our global report, “Health, Nutrition, and Rising Costs”

Insights Report: Health, Nutrition, and Rising Costs

STAY AHEAD