1. IPSOS Nutiani, Consumer Wellness Research (August 2021)

SUGGESTED SEARCHES

Insights Report: The Global State of Health & Wellbeing - Volume 2

Modern consumers are increasingly viewing wellbeing through a more sophisticated lens, choosing to embrace a proactive and holistic approach to achieve their health goals. Healthy eating has also become one of the common actions adopted by consumers, with close to 90% believing well-balanced diets are important to preventing major illnesses¹.

There is a clear opportunity for brands to capture the growing demand for holistic nutrition solutions. However, preferences and needs vary across health-conscious consumers and they are seeking more personalised solutions to fit their lifestyles. Brands need to understand these differences and nuances to effectively tailor their solutions and build deeper consumer relationships.

To support our customers in their personalisation journey, we partnered with leading market research agency, Ipsos, to survey 5,950 people across seven markets on their perceptions and behaviours toward health and wellbeing.

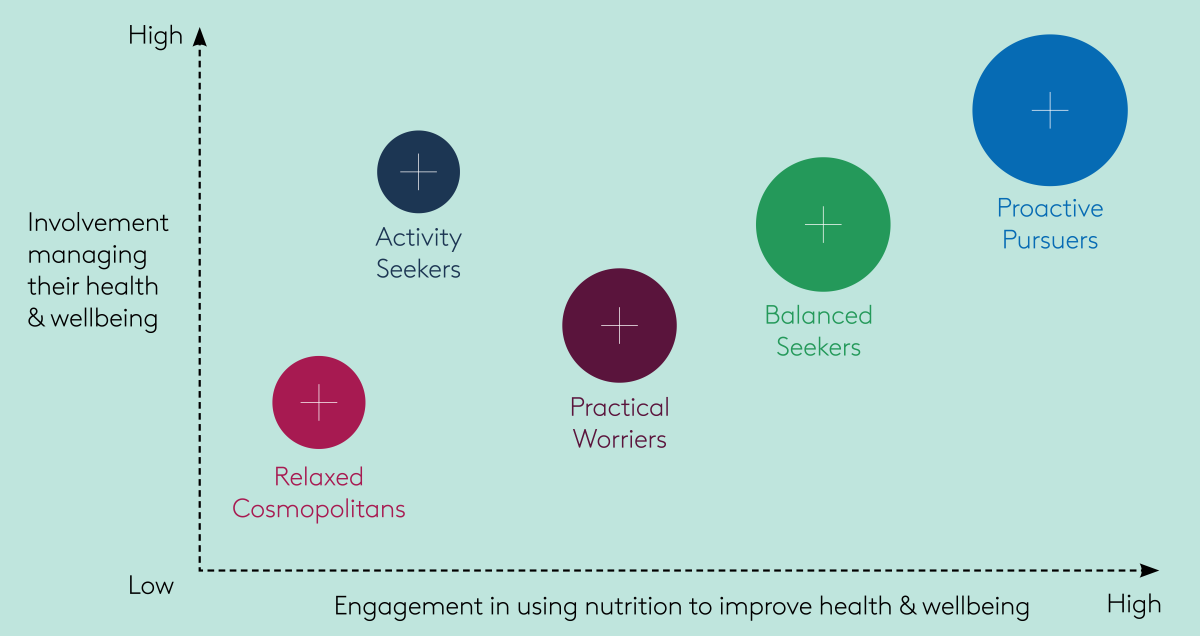

The five health-conscious consumer archetypes

Examining engagement, awareness, motivations and attitudes toward wellbeing and nutrition, the research uncovers five distinct groups that represent the current consumer landscape.

The largest and most highly-engaged of the segments, Proactive Pursuers believe health is holistic, and nutrition has a big impact on overall quality of life. They take a scientific and highly-disciplined approach to food, and are prepared to pay more and sacrifice convenience and indulgence for healthier products.

Balanced Seekers are sensible, informed and happy with where they are in life. They strongly believe that health is holistic, and nutrition has a big impact on overall quality of life. Recognising that there are factors beyond their control, they adopt a practical and relaxed approach to health.

Practical Worriers adopt a balanced, sensible, and informed approach towards life. They acknowledge that nutrition has an impact on their overall wellbeing and tend to worry about their declining mental and physical health. They are focused on making small and manageable changes to improve their wellbeing when necessary.

Relaxed Cosmopolitans are preoccupied with their busy lifestyles and choose to take a balanced, sensible, and informed approach to life. Although they want to do more for their health and wellbeing, they do not have sufficient time or knowledge. They are less likely to be scientific or highly disciplined about nutrition and perceive healthy eating as natural and unprocessed diets.

Activity Seekers are optimistic, competitive, and active. Highly engaged in physical activity, it is their preferred method to manage their health over nutrition. However, they are willing to try new products and are prepared to sacrifice convenience for healthy food and beverages that can boost their performance.

Common barriers and priorities in nutrition behaviour

Incomplete and discrepancies in information around healthy food are holding back consumers from managing their nutrition. Four of the five consumer segments experience a knowledge gap, while the remaining group say they are hampered by conflicting information on available products.

Trust in relation to food safety and quality is one of the main concerns for all consumer archetypes.

The findings also reinforced the need for brands to overcome commonly identified barriers to healthy eating such as taste, cost and convenience, as demonstrated in our Consumer Wellness Research. On top of this, consumers are seeking sustainably sourced and produced products. Our findings revealed a preference for natural and less-processed foods that are known to have a lower environmental impact.

These commonalities indicate that concerns around trust and sustainability are not sufficiently addressed by existing products on the market. There is a growing opportunity to develop solutions that capture this demand and tailor communication to build credibility.

Localised differences emerge

The drive towards globalisation has accelerated in recent years and inevitably impacted consumer behaviour. While some habits are influenced by global trends, our report reveals distinct consumer needs and preferences in each market surveyed, due to the unique macro-environment. Key factors considered include cultural norms, perceived societal challenges and reliance on social media.

China, with health at the core of policy making and consumer priorities, has the largest proportion of Proactive Pursuers.

Japan, which traditionally tends to favour fresh and healthy foods, has the highest proportion of Practical Worriers.

Balanced Seekers are a prevalent segment in Germany, where consumers show greater concern towards longer-term issues like the environment over their day-to-day health and wellbeing.

The United Kingdom has a high proportion of Balanced Seekers, in line with consumers placing greater priority on political, environmental and societal issues such as the rising costs of living.

South Korea has a high proportion of Proactive Pursuers, potentially stemming from its long-standing culture of consuming medicinal foods for wellbeing.

Consumers fall mainly in the Proactive Pursuers and Balanced Seekers segments, but they are limited by cost – potentially caused by growing inflationary pressures and low employment rates.

Known for placing greater emphasis on flavour and eating for pleasure, France has a higher proportion of Balanced Seekers.

Summary

Our research shows there is no one-size-fits-all solution, and reinforces the importance of segmentation to maximise the opportunity this growing market of health-conscious consumers presents. Each consumer archetype is motivated by distinct reasons and barriers, and each geographic market has an added layer of cultural nuance.

To stand out in the highly competitive wellbeing nutrition market, brands need to develop tailored solutions with products and strategies that speak to the consumers’ unique motivations, while addressing the challenges they are facing in managing their health and wellbeing.

1. IPSOS Nutiani, Consumer Wellness Research (August 2021)

STAY AHEAD