SUGGESTED SEARCHES

- Physical Wellbeing

- Inner Wellbeing

- Article

- Mental Wellbeing

- Nutrition and Health

- Trends and Insights

ARTICLE

Top 10 Consumer Trends for Health and Nutrition Brands in 2025

ARTICLE

- Physical Wellbeing

- Inner Wellbeing

- Article

- Mental Wellbeing

- Nutrition and Health

- Trends and Insights

Trends for Health and Nutrition Brands in 2025

Download Slides

Enter your details below and we will provide you with a download link shortly.

Thank You. Please download your resource below.

Download nowOops! Something went wrong. Please try again

Checking permissions...

As consumer preferences and technological advancements continue to evolve, how will the health and nutrition landscape change in 2025?

From the increasing adoption of GLP-1 medications to the surge in personalised nutrition and micro-provenance, brands aiming to lead must grasp these pivotal developments.

At Nutiani, we’ve pinpointed 10 key trends that will take centre stage in 2025. These insights, derived from our independent consumer studies, social listening, and expert analysis, highlight both immediate and long-term opportunities.

In a recent webcast, our Advanced Nutrition experts delved into the first five transformative trends. Additionally, we’ve identified five microtrends that provide innovative insights, empowering brands to confidently navigate the year ahead.

Explore the 5 Health & Nutrition Trends:

people in the world are aged above 55¹.

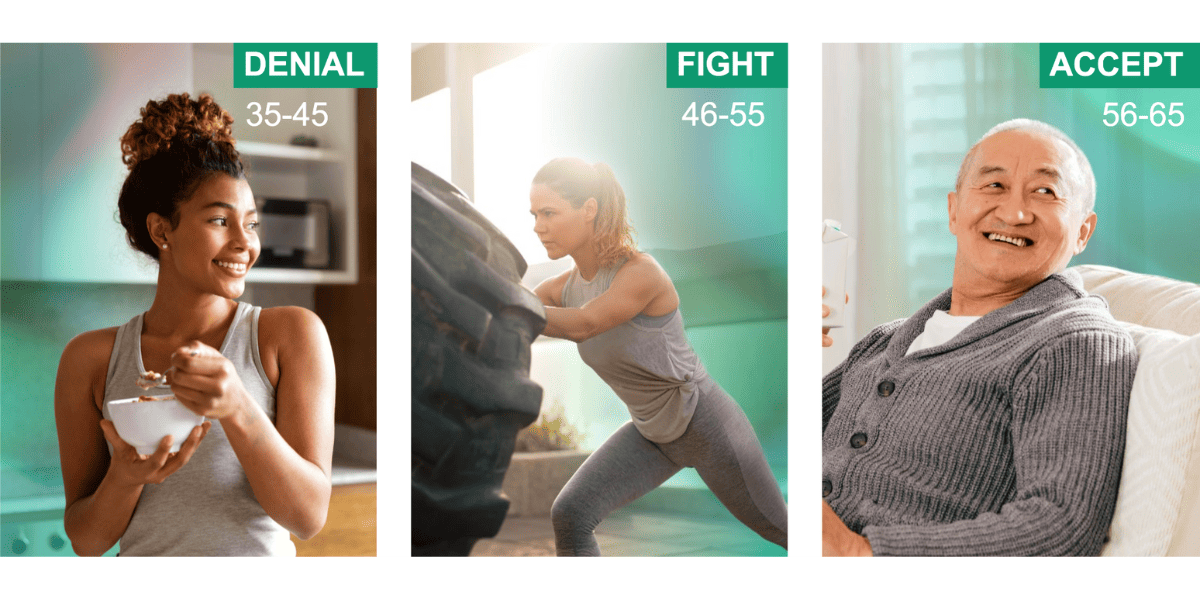

In this rapidly ageing world, healthy ageing is top of mind for 75% of global consumers². This applies not just to senior consumers, but also to younger consumers who are now engaged in ‘proactive prevention’, turning to nutrition to age gracefully.

Find out more about the healthy ageing market in Nutiani’s Proactive Nutrition for Healthy Ageing report:

The silver generation, which includes retired professionals with substantial accumulated wealth, has a significant spending power of $45 trillion³. This presents a golden opportunity for brands, but how can brands engage this powerful and evolving segment?

Cater to the diversity across different age groups. Healthy ageing solutions cannot be one-size-fits-all. The nutritional needs of younger consumers seeking prevention-oriented solutions and those of senior consumers looking to tackle existing health concerns are vastly different. In fact, even within the senior consumer segment, the nutritional needs of those in their 50s and those in their 70s vary significantly.

Traditionally linked to sports nutrition for muscle recovery and building, protein is now being recognised for its broader day-to-day benefits, driving double digits growth in the market⁴.

Weight management is emerging as significant opportunity area for protein, considering the current popularity of GLP-1 appetite-suppressing drugs. Protein-fortified solutions can counter the negative effects or complement the use of these drugs to prevent muscle loss from lower food consumption. How can brands respond?

Innovate and Adapt. Brands can pivot existing products or introduce fresh, innovative protein-rich offerings. For instance, Nutiani’s High Protein Shake, with 40g of protein and a low-calorie count, serves as an excellent alternative beverage for weight-conscious consumers.

Explore Nutiani's Protein Solutions

Mobility

Mini Protein Shake

This convenient, tasty, mini protein shake captures the younger demographic seeking to manage their physical health and mobility.

Mobility

Fortified Protein Powder

Rich in calcium, and high in protein, this easily dissolvable powder supports the strength and health of muscles, bones, joints and energy levels.

Mobility

High Protein Shake

Build breadth in your portfolio by enabling multiple powerful mobility supporting claims in one convenient product.

Mobility

Mini Protein Shake

This convenient, tasty, mini protein shake captures the younger demographic seeking to manage their physical health and mobility.

Mobility

Fortified Protein Powder

Rich in calcium, and high in protein, this easily dissolvable powder supports the strength and health of muscles, bones, joints and energy levels.

Mobility

High Protein Shake

Build breadth in your portfolio by enabling multiple powerful mobility supporting claims in one convenient product.

Mobility

Mini Protein Shake

This convenient, tasty, mini protein shake captures the younger demographic seeking to manage their physical health and mobility.

Mobility

Fortified Protein Powder

Rich in calcium, and high in protein, this easily dissolvable powder supports the strength and health of muscles, bones, joints and energy levels.

Mobility

High Protein Shake

Build breadth in your portfolio by enabling multiple powerful mobility supporting claims in one convenient product.

Mobility

Mini Protein Shake

This convenient, tasty, mini protein shake captures the younger demographic seeking to manage their physical health and mobility.

Mobility

Fortified Protein Powder

Rich in calcium, and high in protein, this easily dissolvable powder supports the strength and health of muscles, bones, joints and energy levels.

Mobility

High Protein Shake

Build breadth in your portfolio by enabling multiple powerful mobility supporting claims in one convenient product.

Mobility

Mini Protein Shake

This convenient, tasty, mini protein shake captures the younger demographic seeking to manage their physical health and mobility.

Mobility

Fortified Protein Powder

Rich in calcium, and high in protein, this easily dissolvable powder supports the strength and health of muscles, bones, joints and energy levels.

Mobility

High Protein Shake

Build breadth in your portfolio by enabling multiple powerful mobility supporting claims in one convenient product.

Mobility

Mini Protein Shake

This convenient, tasty, mini protein shake captures the younger demographic seeking to manage their physical health and mobility.

Mobility

Fortified Protein Powder

Rich in calcium, and high in protein, this easily dissolvable powder supports the strength and health of muscles, bones, joints and energy levels.

Mobility

High Protein Shake

Build breadth in your portfolio by enabling multiple powerful mobility supporting claims in one convenient product.

Mobility

Mini Protein Shake

This convenient, tasty, mini protein shake captures the younger demographic seeking to manage their physical health and mobility.

Mobility

Fortified Protein Powder

Rich in calcium, and high in protein, this easily dissolvable powder supports the strength and health of muscles, bones, joints and energy levels.

Mobility

High Protein Shake

Build breadth in your portfolio by enabling multiple powerful mobility supporting claims in one convenient product.

Mobility

Mini Protein Shake

This convenient, tasty, mini protein shake captures the younger demographic seeking to manage their physical health and mobility.

Mobility

Fortified Protein Powder

Rich in calcium, and high in protein, this easily dissolvable powder supports the strength and health of muscles, bones, joints and energy levels.

Mobility

High Protein Shake

Build breadth in your portfolio by enabling multiple powerful mobility supporting claims in one convenient product.

Mobility

Mini Protein Shake

This convenient, tasty, mini protein shake captures the younger demographic seeking to manage their physical health and mobility.

Mobility

Fortified Protein Powder

Rich in calcium, and high in protein, this easily dissolvable powder supports the strength and health of muscles, bones, joints and energy levels.

Mobility

High Protein Shake

Build breadth in your portfolio by enabling multiple powerful mobility supporting claims in one convenient product.

Mobility

Mini Protein Shake

This convenient, tasty, mini protein shake captures the younger demographic seeking to manage their physical health and mobility.

Mobility

Fortified Protein Powder

Rich in calcium, and high in protein, this easily dissolvable powder supports the strength and health of muscles, bones, joints and energy levels.

Mobility

High Protein Shake

Build breadth in your portfolio by enabling multiple powerful mobility supporting claims in one convenient product.

Mobility

Mini Protein Shake

This convenient, tasty, mini protein shake captures the younger demographic seeking to manage their physical health and mobility.

Mobility

Fortified Protein Powder

Rich in calcium, and high in protein, this easily dissolvable powder supports the strength and health of muscles, bones, joints and energy levels.

Mobility

High Protein Shake

Build breadth in your portfolio by enabling multiple powerful mobility supporting claims in one convenient product.

Mobility

Mini Protein Shake

This convenient, tasty, mini protein shake captures the younger demographic seeking to manage their physical health and mobility.

Mobility

Fortified Protein Powder

Rich in calcium, and high in protein, this easily dissolvable powder supports the strength and health of muscles, bones, joints and energy levels.

Mobility

High Protein Shake

Build breadth in your portfolio by enabling multiple powerful mobility supporting claims in one convenient product.

Mobility

Mini Protein Shake

This convenient, tasty, mini protein shake captures the younger demographic seeking to manage their physical health and mobility.

Mobility

Fortified Protein Powder

Rich in calcium, and high in protein, this easily dissolvable powder supports the strength and health of muscles, bones, joints and energy levels.

Mobility

High Protein Shake

Build breadth in your portfolio by enabling multiple powerful mobility supporting claims in one convenient product.

Nearly 90%

of global consumers indicating that being healthy involves looking after all aspects of health (including both physical and mental wellbeing)².

Today’s consumers also grasp how hormones influence mood, sleep, and mental health, and see the connections between mental wellness, energy, immunity, and focus. Nutrition brands can seize the opportunity by:

Centering on familiar, proven ingredients. Brands can catalyse adoption by demonstrating unexpected benefits of well-established ingredients. For instance, milk phospholipids, a popular ingredient in infant nutrition, can be repositioned to highlight their benefits in stress management. Furthermore, educating consumers on the interconnectedness of health systems like the gut-brain axis empowers them to embrace ingredients like probiotics for mental health support.

Probiotics are undoubtedly the most popular biotic – especially in Asian markets, which made up nearly half of the global volume of probiotics used as food ingredients last year⁵. The biotics market, however, is quickly evolving to encompass much more than just probiotics.

Our research reveals surging adoption of pre- and post-biotics. Yet the biggest potential for growth lies in synbiotics – which combine pre- and probiotics to optimise the health benefits for consumers. Though consumer awareness on synbiotics is currently low, they are gaining traction and offer a massive opportunity for growth. To capitalise on this trend, brands can:

Raise awareness of the lesser-known aspects of biotics. Biotics are increasingly applied in solutions for mental and emotional wellbeing. Moreover, biotics are also a powerful ingredient to support women’s health: Nutiani’s HN001™ is scientifically proven to boost mothers’ mood and metabolic health during the pre- and postnatal period. Sharing research and proof to back up these claims and further educating consumers on biotics’ benefits beyond just digestion can considerably boost this market.

As we accelerate towards the age of hyper-personalised nutrition, technology emerges as the linchpin driving this shift. Wearable devices and biosensors now capture real-time data of physiological responses to individuals' diets. These data-driven insights and smart algorithms power precise, individualised recommendations.

To stay a step ahead of the curve, brands can:

Invest in AI / data analytics research and innovation. Brands can harness emerging technologies to map consumer preferences and develop truly relevant solutions. Additionally, strategic partnerships with technology companies leading this innovation can help nutrition brands solidify their position as an industry-leaders in the personalised nutrition movement.

Bonus 5 Key Consumer Trends:

Our independent research reveals a striking paradox: while a third of consumers struggle with the rising costs of health and nutritional products, consumers are still more proactive than ever on health management.

Nutiani’s Health, Nutrition and Rising Costs Report released in 2024 explores how brands can develop inflation-resilient strategies and value-based innovations that resonate.

Consumers are strategically reallocating their spending, prioritising health over discretionary expenses. 58% of consumers say they will reduce their spend on snacking6. Regardless, health management remains paramount, with an overwhelming 67% of consumers surveyed by Nutiani ranking health and wellbeing as their top priority.

In light of this, how can forward-looking brands respond?

Providing the right value for the right audience. I=Ehrmann's High Protein Chocolate Pudding exemplifies this approach, targeting consumers who prioritise guilt-free indulgence. Its success, despite containing artificial sweeteners, stems from delivering a guilt-free snack that also satisfies cravings.

Relaxation and mood uplift are key emotions that lead consumers to snack. Our independent research informs us that nearly four in 10 consumers snack to relax or boost their moods. Coupled with the rising awareness of healthier lifestyle habits, many are now seeking to indulge in ‘petite pleasures’ which offers the sweet spot of indulgence and health.

65%

of consumers are not keen to compromise on taste and would rather opt for smaller portions⁷.

This shift has brought on a surge in popularity for miniaturised treats crafted with nutrient-dense superfoods and clean ingredients. What brands can do:

Provide the smaller pleasures consumers want. Develop indulgent bites in smaller, bite-sized portions so consumers can manage their indulgences. For instance, Little Moons’ Mochi Ice Cream Balls offers consumers the option to treat themselves to small portions of ice cream at under 100 calories per serving. Aside from taste, the controlled portion (and calories) gives consumers a greater incentive for repurchase.

Portion-controlled products can also be positioned as tools for addressing weight management needs. Products that also boast high protein and essential nutrients can be categorised as companion products that support GLP-1 drug users on their weight loss journey.

Between natural and science-backed ingredients, there exists an emerging demand for ‘naturally functional’ foods. While 78% of consumers are ready to pay more for products labelled ‘all natural’, there’s concurrent demand for higher fortification of foods from 75% of consumers.

Even though this phenomenon may appear contradictory, at its core, it’s an indication that consumers are looking for higher nutrient density from food. For many, their understanding of nutrient density is linked to their own natural understanding which brands can leverage on.

Did you know?

The almond market has grown from $800 million in 1999 to more than $8.3 billion in 2023, after almonds were more actively applied in food products and snacks.

There is thus a great opportunity for brands to leverage on existing knowledge and trust in natural ingredients from consumers. For example, greek yogurts are already well-established nutritional powerhouses in the public consciousness.

How else can brands respond to this trend?

Our research has shown that environmental concerns is now the third most pressing issue for global consumers, trailing behind economic instability and the cost-of-living crisis.

Many are now willing to pay a premium for products that align with their values. Factors such as sustainability and transparency are key influence on their decisions, as consumers want to support brands that commit to tangible social responsibility in their ingredients and brand mission.

27%

of global consumers have actively boycotted a product or brand due to its ethical credentials in the last two years.

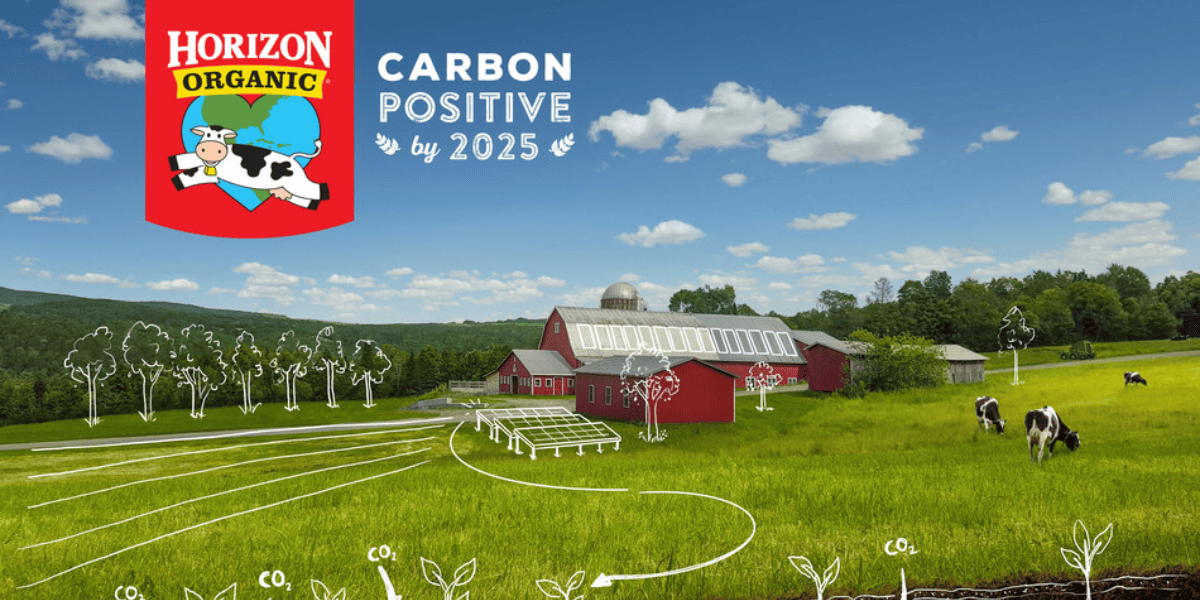

All that said, brands should be aware that there is also growing scepticism around corporate commitment to environmental issues, primarily due to greenwashing.

To ensure that they are addressing sustainability in an impactful and authentic, yet ethical way, brands must:

Back green claims with robust evidence. To avoid instances of greenwashing, sustainability claims must be backed by research, action and evidence. Horizon Organic is a good example of a brand that effectively communicates its carbon-positive and environmentally-friendly strategies with its audience. With a focus on regenerative agriculture on top of how it reduces its carbon intensity through operations, the company demonstrates its long-term commitment and accountability to its value chain.

Today, provenance is no longer just about ingredient source. Instead, consumers are also paying attention to benefits that come with it – assurance, community support, and confidence in quality.

51%

of global consumers say that sourcing of traceability/ingredients is important, according to research from FMCG Gurus.

With this demand comes a growing willingness for consumers to pay a premium for locally sourced, or sustainably sourced products. Brands who are able, should convey authenticity, traceability and transparency of ingredients, as well as compelling narratives around the product’s creation and concept, to address the different definitions of provenance that consumers may have.

What can brands consider?

Global but traceable to support local. Not every market or region will have the ingredients for the innovative products developed by brands. However, with enough details about where these ingredients are sourced in their local regions, and the specific communities the brand supports, consumers will remain open to trying out new foods.

Intermarché’s Sélection Les Éleveurs Vous Disent Merci! Range features farmer photos and a breakdown of their share of the product's price on the packaging. This transparency will also create a strong narrative of the brand’s commitment to quality and supporting independent producers.

The health and nutrition industry is a dynamic ecosystem, constantly evolving in response to changing consumer demands and technological advancements. In a market saturated with fleeting fads, discerning brands must decipher enduring consumer shifts.

Our webcast and market analysis provide a solid framework for brands to navigate consumer trends and adopt effective strategies. From product ideation to launch, Nutiani stands ready to help you advanced your business growth through our science-backed, data-driven solutions.

MEET THE EXPERTS

Pooja Passi

Head of Insights, Advanced Nutrition

Pooja specializes in consumer insights, with proven expertise in integrating insights with business strategy, innovation, measurement, shopper and communication development. Across a career spanning 20+ years, she has held leadership roles in large FMCG companies as well as research agencies. Pooja has deep experience in India, South East Asia, China and Africa.

Rebecca Cuthbertson

Head of Marketing, Advanced Nutrition

Rebecca Cuthbertson is the Head of Marketing, Advanced Nutrition at Fonterra. With over 20 years of global marketing experience across both B2C and B2B industries, she has been instrumental in developing insights-led growth strategies and compelling value propositions that support brands in achieving sustained success.

2. 2023 Nutiani Ipsos Consumer Wellness Research

6. Global Data Customer Survey 2024

7. Taste Tomorrow

From the growing use of GLP-1 medications to the rise of personalised nutrition and a leaning towards provenance, brands who want to stay ahead of the curve must understand these influential developments.

At Nutiani, we’ve pinpointed 10 key trends that will take centre stage in 2025. These insights, derived from our independent consumer studies, social listening, and expert analysis, highlight both immediate and long-term opportunities.

The first five trends were explored in a recent webcast featuring our Advanced Nutrition experts, while the additional five microtrends offer fresh insights to help brands navigate the year ahead.

Innovation Hub

A resource hub for all things health and wellbeing.

Article

Eating well for a healthy mind

Sep 04, 2022

Article

Tackling stress through nutrition

Sep 04, 2022

Inner Wellbeing

The Immunity Opportunity for Nutrition

Sep 04, 2022

Stress and Mood

Taking Action on Mental Health

Oct 17, 2022

Innovation

Healthy Ageing

With mobility’s significant influence on independence and quality of life, one of the most pressing questions in the healthy ageing community is; what can we do to improve mobility outcomes as we age?

Aug 02, 2022

Inner Wellbeing

Lactoferrin: A Super-Ingredient

The link between diet and immunity is becoming an increasing focus for consumers, who are seeking help from superfoods and ingredients to help keep them fighting fit.

Sep 02, 2022

Physical Wellbeing

How Exercise and Nutrition Can Support Muscle Health

Sep 03, 2022

Physical Wellbeing

How to adopt a holistic approach to weight and wellbeing

Sep 04, 2022

Article

Eating well for a healthy mind

Sep 04, 2022

Article

Tackling stress through nutrition

Sep 04, 2022

Inner Wellbeing

The Immunity Opportunity for Nutrition

Sep 04, 2022

Stress and Mood

Taking Action on Mental Health

Oct 17, 2022

Innovation

Healthy Ageing

With mobility’s significant influence on independence and quality of life, one of the most pressing questions in the healthy ageing community is; what can we do to improve mobility outcomes as we age?

Aug 02, 2022

Inner Wellbeing

Lactoferrin: A Super-Ingredient

The link between diet and immunity is becoming an increasing focus for consumers, who are seeking help from superfoods and ingredients to help keep them fighting fit.

Sep 02, 2022

Physical Wellbeing

How Exercise and Nutrition Can Support Muscle Health

Sep 03, 2022

Physical Wellbeing

How to adopt a holistic approach to weight and wellbeing

Sep 04, 2022

STAY AHEAD

New solutions, unique benefits and emerging trends. No junk.

Thanks for subscribing!

Oops, something went wrong

All rights reserved © Nutiani 2024